Introduction: What to Know Before Buying a Home in the Bay Area

Bay Area home buying exists in one of the most competitive, unique, and fast-moving real estate markets in the country.

As a result, buying a home here is different from almost anywhere else in the US, and the more you understand upfront, the fewer surprises you’ll face later.

This guide walks you through what you really need to know before you buy in the Bay Area. It is written based on real situations buyers run into every day, and it will be especially helpful if this is your first time entering this market.

What Cities make up the Bay Area?

Many buyers think the Bay Area only includes San Francisco, San Jose, and Oakland. However, the region spans nine counties and dozens of cities. Therefore, each area comes with its own pricing, lifestyle, commute patterns, and levels of competition.

South Bay

San Jose, Santa Clara, Sunnyvale, Cupertino, Mountain View, Milpitas, Los Gatos, Campbell, Saratoga

East Bay

Fremont, Newark, Union City, Hayward, Castro Valley, San Leandro, Berkeley, Oakland, Pleasanton, Dublin, Livermore, Walnut Creek, Concord

Peninsula

Palo Alto, Redwood City, San Mateo, Foster City, Belmont, Burlingame, South San Francisco

San Francisco

Sunset, Richmond, Noe Valley, Mission, SOMA, Pacific Heights

North Bay

Marin, Napa, Sonoma, Vallejo, Benicia, Fairfield

Therefore, understanding these differences is important. first step for successful Bay Area home buying.

Why Different Cities bring Different Buying Challenges

When buyers begin touring homes, they quickly notice how dramatically the experience changes from one city to another. For example:

- Some cities consistently have bidding wars on almost every home.

- Some have older properties that need major upgrades.

- Certain neighborhoods get 15 to 30 offers on one listing

- Some neighborhoods have extremely limited inventory.

- Newer communities may have higher HOAs or added assessments.

- Some zip codes practically require non-contingent offers to even be considered.

Even the age of homes varies significantly:

- San Jose, Fremont, Hayward → mostly built during the 1950s–1980s.

- Dublin, Mountain House → newer homes with added taxes or assessments.

These variations can lead to unexpected costs and competitive pressure. As a result, researching each city becomes essential.

The Bay Area is Powered by the Tech Industry

One of the biggest reasons the Bay Area behaves differently from the rest of the country is the tech economy. As a result, even when the national market slows, Bay Area demand stays high.

Normal market corrections often don’t reduce prices much here because:

- Tech salaries keep the buyer pool strong.

- Inventory remains low.

- Job opportunities keep people in the region.

- International demand is strong in certain cities.

- Top school districts push prices up long term.

This consistent demand is why buying a home in the Bay Area often requires strategic planning and financial flexibility.

Property Taxes: What Buyers should expect

California property taxes range from 1.1% to 1.25% depending on the county and city.

Typical yearly costs:

- $1M home: $11,000–$12,500

- $1.5M home: $16,000–$19,000

Newer construction may include extra assessments, increasing taxes even more. Therefore, long-term affordability should include both mortgage and property taxes.

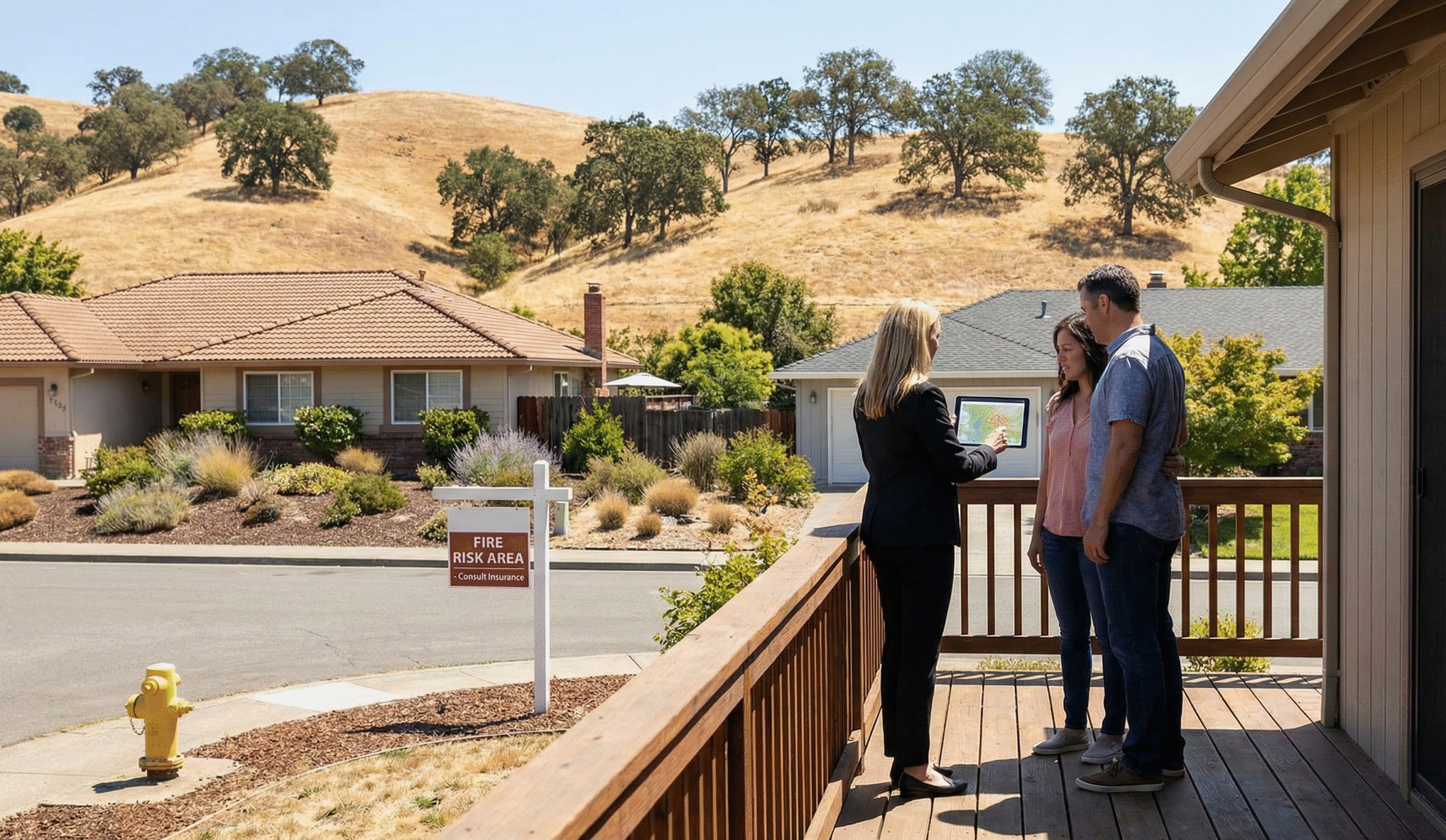

Insurance Considerations Across the Bay Area

Insurance is becoming a major factor for Bay Area buyers. Homes located near dry grasslands, hills, or wildland zones often face higher premiums or fewer carriers. As a result, these homes may require additional fire protection features or specific roof conditions.

Before choosing a neighborhood, review:

- Fire-risk zones

- Roof age and material

- Distance from dry areas

- Insurance quotes from multiple carriers

Because insurance affects monthly expenses, understanding these variables early helps avoid surprises.

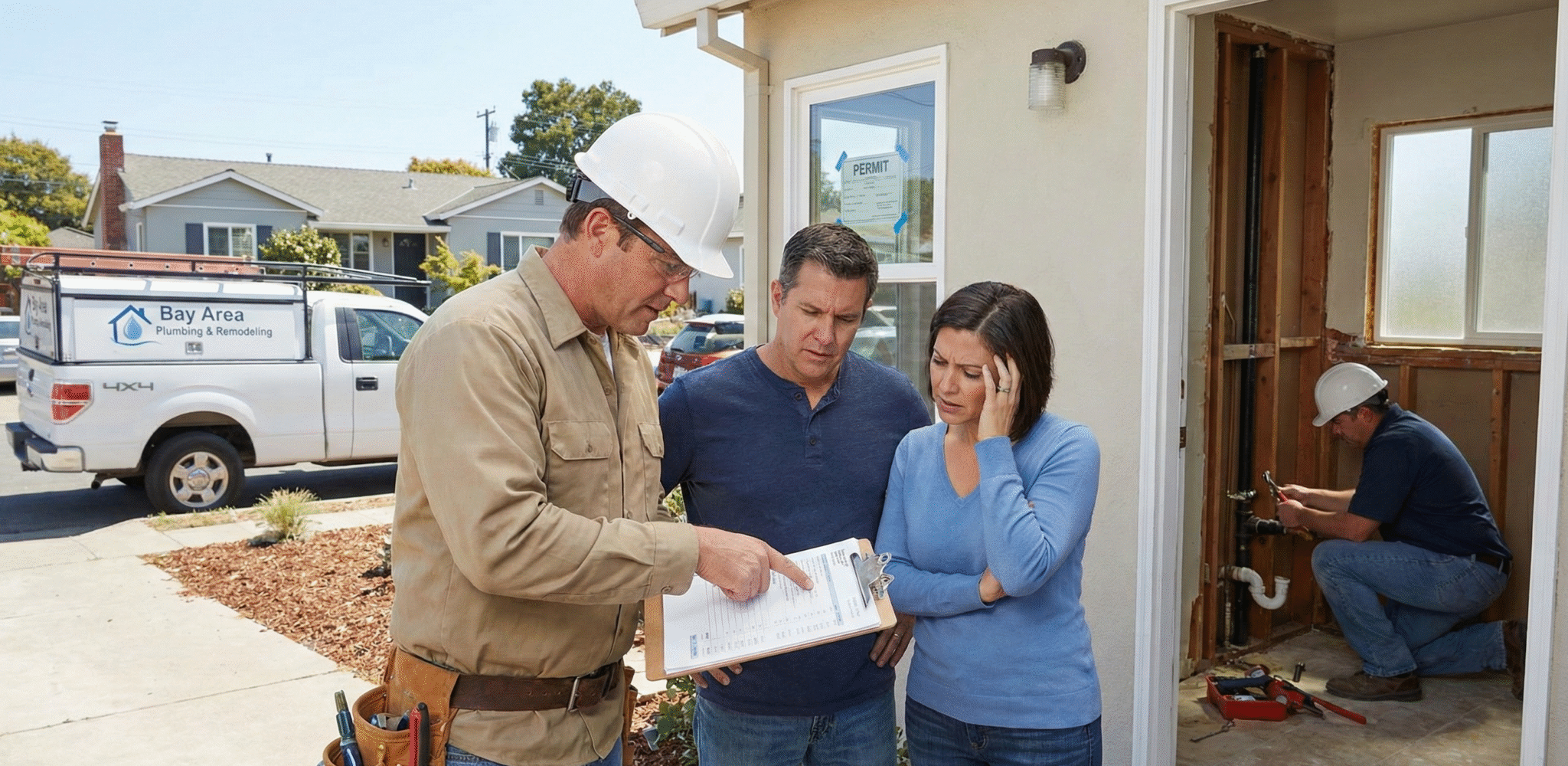

Maintenance and Repair Costs are Much Higher

Bay Area labor costs are significantly higher than most places due to:

- High cost of living for contractors

- Shortage of skilled labor

- Expensive permitting processes

- Strong demand because many homes are older

Simple projects like water heater replacements, plumbing fixes, bathroom remodels, or roof repairs can cost double compared to other states.

If you’re buying an older home, it’s important to budget for ongoing maintenance.

Competition and Bidding Wars are very Common

In high-demand neighborhoods, a well-priced home can receive several offers within days. Because of that, buyers often compete with:

- Cash buyers

- Offers above asking

- Buyers waiving contingencies

- Fast closing timelines

- Non-contingent offers

This competitive environment is one of the defining experiences of Bay Area home buying process.

Review Disclosures Thoroughly before making an Offer

Strong offers often require reviewing disclosures upfront. These may include:

- Roof condition

- Pest/termite reports

- Sewer line notes

- Renovation history

- Foundation details

- Known defects

- HOA documents

Therefore, a thorough review helps you understand risks before drafting your offer.

Understanding Appraisal Gaps

When offers exceed the listing price, the lender bases your loan on the appraised value, not your offer.

Example:

- Offer: $1,300,000

- Appraisal: $1,200,000

- Buyer covers $100,000 difference out-of-pocket

This scenario is common in the Bay Area home buying process. Therefore, discussing appraisal strategies with your lender early is crucial.

Additional things to Consider before Buying a Home in the Bay Area

- School rankings influence demand and appreciation

- Commute times can vary drastically

- Climate conditions shift between cities

- Some HOAs restrict pets, rentals, or renovations

- Older neighborhoods may have aging infrastructure

- Hot markets often go pending within a week

- Inventory stays low due to long-term residents

Therefore, understanding these details helps you make thoughtful decisions.

Conclusion: Moving Forward with Confidence

Bay Area home buying requires patience, planning, and a thoughtful approach. Every neighborhood behaves differently, and competition can be intense. Ficustree.ai gives buyers clarity about affordability, neighborhood conditions, ongoing costs, and market risks so they can move forward confidently.